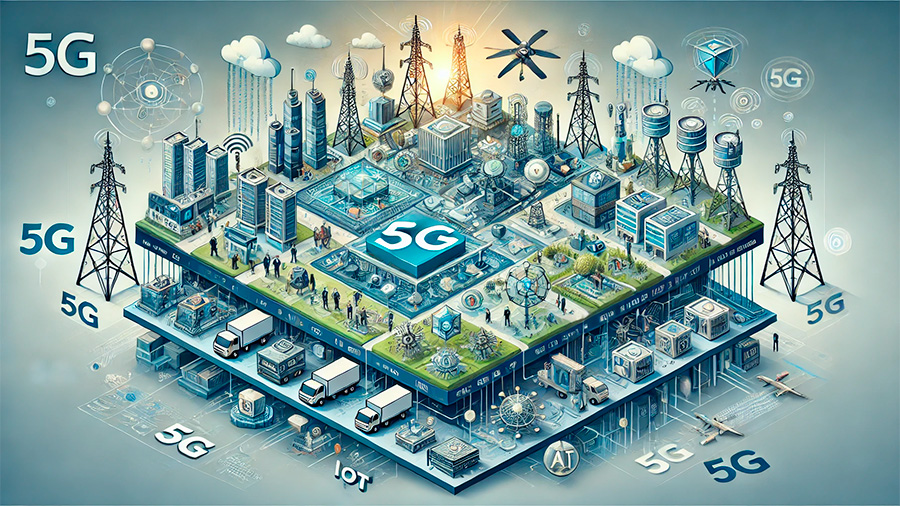

The 5G revolution is transforming the way we connect, communicate, and do business. As the latest generation of mobile network technology, 5G offers faster speeds, lower latency, and the ability to connect millions of devices simultaneously. From enabling smart cities to enhancing artificial intelligence and autonomous vehicles, the potential applications of 5G are vast. For investors, this presents a unique opportunity to profit from the growing demand for connected technology.

As industries from healthcare to entertainment embrace 5G, the market is expected to grow rapidly, with major companies investing heavily in infrastructure, devices, and applications. The global 5G market is projected to reach $1.87 trillion by 2030, with significant growth in sectors such as telecommunications, cloud computing, and the Internet of Things (IoT).

In this article, we’ll explore the opportunities for profit in 5G technology and how investors can position themselves to capitalize on this connected future.

Why 5G Is a Game-Changer

5G represents a significant leap forward in mobile technology, providing faster and more reliable connections compared to previous generations. This enhanced connectivity is driving innovation across industries, creating new business models and opportunities for growth.

Faster Speeds and Lower Latency

One of the most exciting features of 5G is its speed. 5G networks are expected to be up to 100 times faster than 4G, enabling real-time data transfer and seamless communication between devices.

Download speeds: With 5G, users can download high-definition movies, large files, or even entire software programs in seconds, dramatically improving the user experience.

Low latency: Latency, or the time it takes for data to travel between devices, is significantly reduced with 5G. This opens the door to real-time applications such as autonomous vehicles, remote surgeries, and interactive gaming.

These improvements make 5G the backbone of future technological advancements, from self-driving cars to virtual reality, positioning it as a key driver of global economic growth.

Massive IoT Connectivity

5G technology will be essential in supporting the Internet of Things (IoT), a network of interconnected devices that collect and exchange data. From smart homes and wearable devices to industrial automation, IoT is expected to revolutionize how we interact with the world.

- More connected devices: 5G can support up to 1 million connected devices per square kilometer, compared to around 4,000 devices on a 4G network. This increase in connectivity will enable the widespread adoption of smart technologies.

- Industrial IoT: Industries such as manufacturing, agriculture, and logistics will benefit from 5G-enabled IoT solutions, optimizing processes and improving efficiency through automation, predictive maintenance, and real-time data analytics.

Investors who recognize the potential of 5G to power IoT advancements stand to benefit from the growth of this interconnected ecosystem.

Key Investment Opportunities in 5G

The 5G ecosystem is complex, with multiple layers of investment opportunities spanning infrastructure, devices, and applications. By understanding the different components of the 5G rollout, investors can identify areas with the most potential for growth.

1. Telecommunications Companies

Telecom companies are at the forefront of the 5G revolution, as they build the infrastructure necessary to support this next-generation network. These companies are investing heavily in 5G networks, upgrading their systems to deliver faster speeds and lower latency to customers.

- Network providers: Major players like Verizon, AT&T, and T-Mobile are leading the charge in rolling out 5G networks across the U.S. and globally. These companies have invested billions in 5G infrastructure and spectrum acquisition to provide coverage to more consumers and businesses.

- Global telecoms: International telecom providers such as China Mobile, Vodafone, and Deutsche Telekom are also key players in the 5G rollout, with significant investments in expanding 5G networks across Europe, Asia, and other regions.

For investors, telecom stocks offer the potential for steady growth as 5G adoption accelerates, driven by rising demand for faster and more reliable connectivity.

2. Semiconductor Manufacturers

Semiconductors are the backbone of 5G technology, powering the devices and infrastructure that make the network possible. As 5G adoption grows, so will demand for semiconductors used in smartphones, data centers, and IoT devices.

- Leading semiconductor companies: Companies like Qualcomm, Broadcom, and NVIDIA are at the forefront of developing 5G chips and processors. These companies provide the essential hardware that enables 5G devices to function, from smartphones to autonomous vehicles.

- High-performance computing: 5G networks require significant computing power to handle the increased data traffic and processing demands. Companies specializing in high-performance computing chips, such as AMD and Intel, stand to benefit from the growing need for data processing in 5G networks.

Semiconductor stocks offer investors exposure to the technological advancements driving 5G, with the potential for significant growth as demand for chips increases.

3. 5G Infrastructure and Equipment Providers

Building a 5G network requires massive infrastructure investment, including cell towers, fiber-optic cables, and network equipment. Companies that provide the necessary hardware for 5G infrastructure are poised to benefit from the global rollout.

- Tower companies: American Tower, Crown Castle, and SBA Communications own and operate the cell towers that are essential for 5G networks. As telecom providers expand their 5G coverage, these companies will see increased demand for tower space to support the new network.

- Networking equipment: Companies like Ericsson, Nokia, and Huawei are key suppliers of 5G networking equipment, providing the hardware needed to build and maintain 5G infrastructure.

Investing in infrastructure and equipment providers gives investors exposure to the companies powering the physical rollout of 5G, which is expected to continue for years as networks expand globally.

4. 5G-Enabled Devices and Applications

As 5G becomes more widespread, there will be a growing demand for 5G-enabled devices and applications. From smartphones and wearable devices to autonomous vehicles and augmented reality, the applications of 5G are vast.

- Smartphones: Companies like Apple and Samsung are leading the way in 5G-enabled smartphones. As consumers upgrade to 5G-capable devices, these companies are positioned to benefit from increased sales and market share.

- Autonomous vehicles: 5G is expected to play a critical role in the development of self-driving cars, providing the real-time data transfer needed for vehicles to communicate with each other and their surroundings. Companies like Tesla and Waymo are at the forefront of this technology.

- Augmented reality (AR) and virtual reality (VR): The faster speeds and low latency of 5G make it ideal for immersive technologies like AR and VR. Companies developing AR and VR applications, such as Facebook (Meta) and Microsoft, are well-positioned to benefit from 5G’s capabilities.

As 5G-enabled devices and applications become more integrated into everyday life, the companies that develop and sell these products will see significant growth opportunities.

Risks to Consider in 5G Investing

While 5G presents significant investment opportunities, there are also risks to consider. As with any emerging technology, challenges related to regulation, competition, and market adoption can impact the growth of 5G investments.

Regulatory Challenges

5G networks are subject to government regulations, particularly around spectrum allocation and security concerns. In some regions, regulatory delays or restrictions on 5G deployment could slow down network expansion and reduce investment returns.

- Spectrum auctions: Governments control the radio frequency spectrum used for 5G networks. Spectrum auctions can be costly for telecom companies, potentially affecting profitability.

- Security concerns: Concerns over the security of 5G networks, particularly related to the involvement of companies like Huawei, have led to restrictions in some countries. These regulatory hurdles could impact the global rollout of 5G.

Investors should stay informed about regulatory developments and how they may impact 5G companies in different regions.

Competition and Market Adoption

The 5G market is highly competitive, with numerous companies vying for market share. As more players enter the space, competition could lead to pricing pressures and reduced profit margins.

- Telecom competition: Major telecom providers are competing aggressively to capture 5G market share, which could result in lower pricing and increased capital expenditures to differentiate their networks.

- Adoption pace: While 5G adoption is expected to grow rapidly, the pace of adoption could vary by region and industry. Some sectors may take longer to implement 5G technology, impacting the revenue growth of 5G-related companies.

Understanding the competitive landscape and monitoring market adoption trends is key to managing risk in 5G investments.

Long-Term Outlook for 5G Investments

Despite the risks, the long-term outlook for 5G investments is overwhelmingly positive. As 5G networks expand globally and new applications emerge, the demand for 5G technology will continue to grow. Industries such as healthcare, manufacturing, transportation, and entertainment are already beginning to harness the power of 5G, and this trend is expected to accelerate in the coming years.

Global Growth Potential

The global rollout of 5G is still in its early stages, with significant opportunities for growth in both developed and emerging markets. As countries invest in 5G infrastructure, the companies providing the technology, devices, and services will see substantial growth opportunities.

Emerging markets: In countries with less developed telecommunications infrastructure, 5G presents an opportunity to leapfrog older technologies and adopt the latest network standards. This creates new growth markets for telecom providers and device manufacturers.

Innovation and New Applications

As 5G technology matures, new applications and business models will emerge, creating additional opportunities for investment. From telemedicine to smart cities, the potential for innovation is vast, and companies that lead in developing 5G-enabled solutions will be at the forefront of this revolution.

Final Thoughts: Profiting from 5G Investments

The 5G revolution is unlocking a wealth of investment opportunities across multiple industries. By focusing on key sectors such as telecommunications, semiconductors, infrastructure, and 5G-enabled devices, investors can position themselves to benefit from the rapid growth of this transformative technology.

As with any investment, it’s important to be aware of the risks, including regulatory challenges and competition. However, for long-term investors who recognize the potential of 5G to reshape the global economy, the rewards can be substantial. By investing in 5G today, you can capitalize on the connected future and profit from one of the most significant technological advancements of our time.